How to Apply for CPQ?

There are a few steps to take when you’re ready to start on your CILEX Professional Qualification journey. Before you get started, make sure you have your documents to hand to prove any exemptions. It’ll only take around 15 minutes to get enrolled.

What to do next

Step 1: Become a CILEX member

First you need to join CILEX and become a member (if you are not a member already). It’s a simple process to join and pay for your membership fee in your myCILEX portal; you’ll need to provide evidence of any previous legal qualifications which will determine the grade of membership you are eligible for, and the appropriate CPQ stage for you to start.

Step 2: Purchase CPQ

Once you have joined CILEX as a member, you’re ready to purchase CPQ. We now have new flexible pricing available to suit every budget when you purchase CPQ; you can choose to pay the full cost upfront or set up a Direct Debit to spread your payments over twelve months. You can also arrange for your employer to pay:

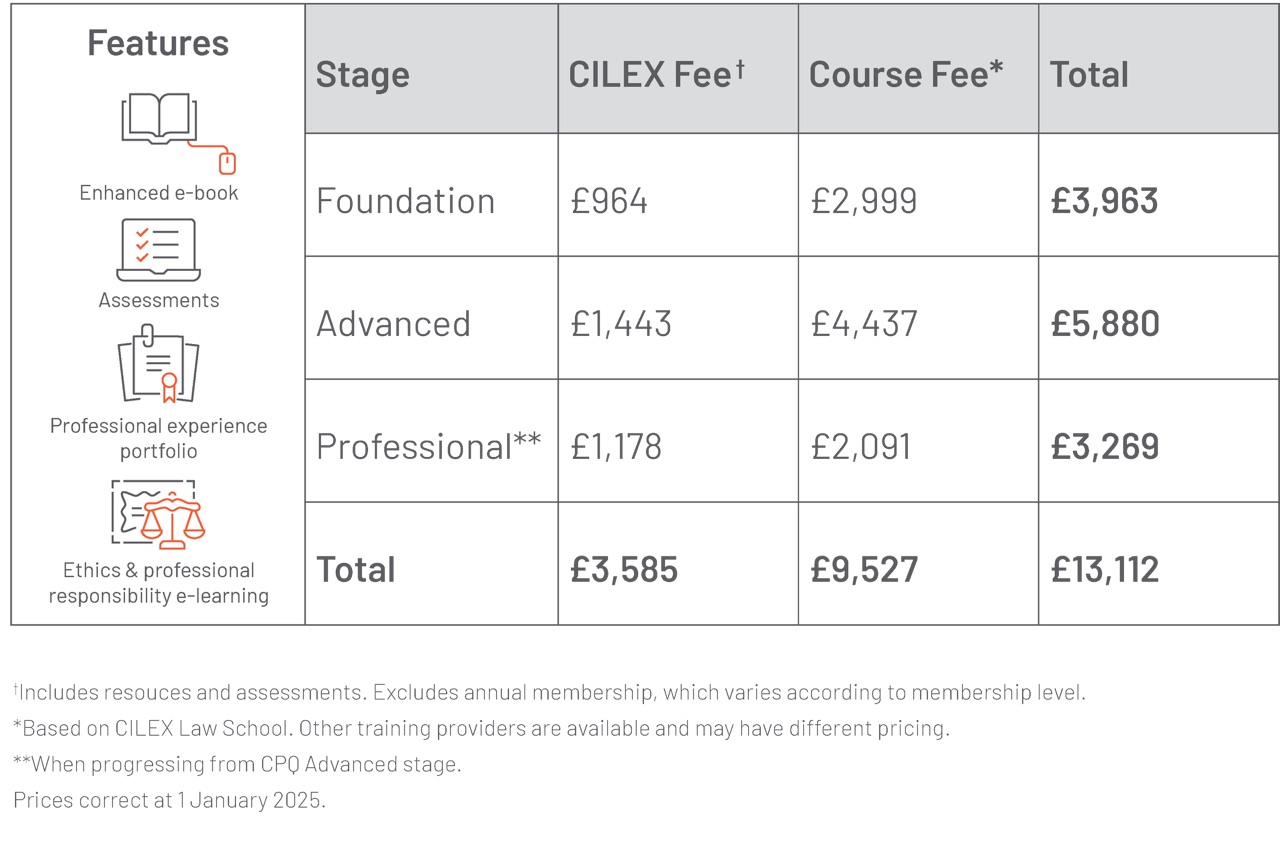

a) Purchase a CPQ stage (or stages)

If you are ready to purchase one or more stages of the CPQ, over the longer term this is the cheapest option. You will receive a discount on both CPQ Foundation stage and CPQ Advanced stage. See indicative prices in the table below:

b) Purchase on a modular basis

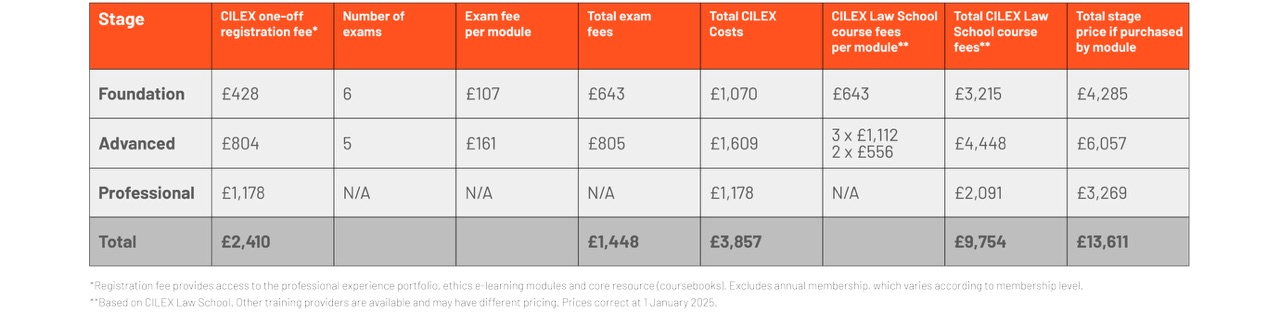

If you would prefer to spread the cost, then this could be the right option for you and the cost of CPQ will be more evenly spread across the period of qualification. There will still be a requirement to complete the overall stage within three years from the point of registration.

There will be an exam fee for each exam entry, paid at the point when students are ready to sit an exam. The fees for purchasing CPQ modules as you progress through the stage are outlined in the table below:

Follow the links in your myCILEX Portal as part of the payment process.

Follow the links in your myCILEX Portal as part of the payment process.

Step 3: Enrol with your Training Provider

If you’ve chosen to study with CILEX Law School, you’ll be able to enrol on your course in your MyCILEX portal. If you’ve decided to study with another Training Provider, you’ll need to enrol directly with them.

We’re here to help guide you every step of the way

Helpful advice is always available from our team of experts whenever you need it – if you have any queries about CPQ, including choosing the right pathway for you, it’s quick and easy to register on our portal and submit an enquiry so we can assist you.

Find the right Training Provider for you

Our qualifications are offered by a selection of approved training providers. Some, like the CILEX Law School specialise in distance learning, and some local colleges offer both remote and classroom learning, so you’ll be able to find the best option to suit you.